Contents:

I hope this simplified explanation of the CCI Indicator can give you a head start of how useful this trading indicator for Share Market Technical Analysis can be. The government is also contemplating to let six key ministries, which execute public-private partnerships in infrastructure, hire professional transaction advisors at attractive pay packets. The capital market regulator, for example, is considering to set up a specialised arm to track down complex market manipulations.

- Consumer confidence should be boosted by the early indications of reducing inflation, opening up the contact-intensive services sector, the start of the holiday season, and improving the agricultural outlook.

- The commodity channel index is computed by taking the difference between the current price of a financial asset and its moving average, and later to be divided by the mean absolute deviation of the price.

- Traders use the commodity channel index to help identify price reversals, price extremes and trend strength.

- In 1967, when the post World War II boom started to slow down, the United States created the first consumer confidence index .

- Like most indicators, CCI is best used not as a stand-alone indicator but in conjunction with others.

- Lambert also used a daily timeframe as the primary one to spot the entry signals of the indicator.

I would suggest to play with, so you can decide if it works the best for you. In momentum-based trading, traders mostly focus on stocks that are giving significant moves in one direction on high volumes. The RSI compares the relationship between the average of up-closes and the average of down-closes over a particular time period, usually 14 days. From oversold levels, a CCI advance above -100 and trend line breakout could be considered bullish. The Commodity Channel Index or CCI Indicator is one of the many technical analysis indicators that I used for my trading endeavors.

Expert Assisted Services

Trend Analyser is a professional charting and analysis software that comes with state-of-the-art tools to determine trend, momentum, buy and sell points for stocks. Created By, Trading Fuel Form this example, you can see that at the same time both indicator gives sell signal as there is negative divergence. For buy trade, when both indicators give, positive divergence or oversold signal or trend breakout, you can go for the buy trade. When CCI and come out from overbought zone (i.e. crosses the +100 level, from below) and also check that the price crosses the moving average in the same direction. When CCI comes out from the oversold zone and also checks that the price line should intersect the moving average chart from below. You can look for divergences in the CCI and also the price trend, trend line breaks of the CCI indicator gives good result.

2 Best-In-Class REIT Buying Opportunities – Seeking Alpha

2 Best-In-Class REIT Buying Opportunities.

Posted: Tue, 04 Apr 2023 12:05:00 GMT [source]

When https://1investing.in/s are optimistic about both the country’s present and future economic conditions as well as their own financial situation, they tend to boost their consumption. According to CCI + SRSI trading strategy, first, from both indicators, you need to get matching signals like overbought/oversold signals, divergences, or trend breakouts. Momentum-based traders may hold their positions on varying time frames including several minutes, few hours or even the full trading day, based on how quickly the stock moves in case of directional change. It is the most preferred tool of investors who do technical analysis to make intra-day trades. Technical analysis operates on the assumption that market forces almost instantly incorporate the vast majority of available stock, bond, commodity, or currency information into the price.

What are the Best Technical Indicators?

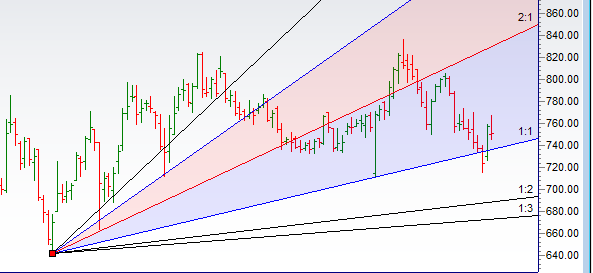

Time and time again it is demonstrated how important momentum is when analyzing the market and attempting to determine future moves. Whether you are using CCI to confirm trends or to look for reversals, its momentum quantifying prowess should not go unnoticed. Like most indicators, CCI is best used not as a stand-alone indicator but in conjunction with others. Overbought or oversold levels are not fixed since the indicator is unbound. We will take a look at the continuous Brent Oil futures contract in a 30-minute timeframe to pick out a few example trades.

The CCI is a versatile indicator proficient at producing a wide array of buy and sell signals. It is a moment based oscillator which is used to identify the prices at which the stock is overbought or oversold. Library “MomentumIndicators” This is a library of ‘Momentum Indicators’, also denominated as oscillators. The purpose of this library is to organize momentum indicators in just one place, making it easy to access. In addition, it aims to allow customized versions, not being restricted to just the price value.

CCI is used to Spot Divergence

Standard Deviation is a simple moving average plotted not by typical prices, but by value (Typical Price – SMA). That is, first you need to subtract a simple moving average value from the typical price value, and then average the obtained value by the SMA formula once again. They interpret levels above 100 as overbought regions and bearish signals, and levels below -100 as oversold regions and bullish signals. CCI, like other oscillators, may be used to identify divergence or confirmation of a new price extreme.

As we can see from the graph, we have found several profitable trading opportunities in a relatively short time span, with one clear whipsaw. Let’s look at trades 4 and 5 and see how we could have traded them using our trading strategy. Once you know your profitable CCI levels, you know your entry points. As mentioned, the CCI indicator is an unbound indicator, meaning its values can go below -100 and above 100. Therefore, it is best to know which values are typical and which are abnormal in the market you are trading. Once the CCI-3 dips below -100 , the question of trading tactics comes up.

Technical Corner

From overbought levels, a CCI decline below +100 and a trend line break could be considered bearish. The CCI did not concur with the Opposite Parties’ argument that such increase was due to market forces, higher investment and interest burden. The CCI, in light of the above, concluded that the Opposite Parties had formed a cartel in contravention of the provisions of the Act. One that is capable of forecasting emerging trends, overbought, and oversold signals.

Currently, the Competition Commission of India has only two members and the post of Chairperson is vacant since Ashok Kumar Gupta retired on October 25, 2022. Basically, the CCI acts as a speedometer of the market which gives indications of a wide array of buy and sells signals. In a nutshell, this trading indicator measures the variation of price from its statistical mean. The finance ministry has raised objections to the proposed pay scale of the members and the chairman of the Competition Commission of India , which is more attractive than that of government officials. The ministry of corporate affairs wants to hire experts who could do complex economic analysis for investigation and adjudication, which may not be possible with the pay scale that exists.

While any move to -100 suggests weakness and beginning of a downtrend. The trend line break of the CCI is also keenly observed by the traders. These typical price divergences are usually followed by a correction in price, resulting in an opportunity to trade. High CCI values indicate that prices are unusually high compared to average prices whereas low values show that prices are unusually low. It further maintained that although the correlation of absolute prices is a sufficient indicator to establish price parallelism, it was not the sole indicator of the existence of a cartel. Despite the government’s oft-repeated concern about cartels pushing up prices of key commodities, the competition regulator will not get the teeth to investigate them soon.

Which is better RSI or CCI?

This occurs whenever new price peaks and valleys are not mirrored by corresponding momentum peaks and valleys. Such divergences highlight possible trend reversals. Generally speaking, the RSI is considered a more reliable tool than the CCI for most markets, and many traders prefer its relative simplicity.

In the January survey, the how do squatter’s rights work condition index increased from 114.9 to 116.2 points. In India, the CCI is calculated by the Reserve Bank of India , and it is based on a survey of around 5,400 households across 13 major cities in the country. The survey is conducted by the RBI in collaboration with market research firm, Centre for Monitoring Indian Economy .

Portugal’s Aveiro region stays at the forefront of tech innovation – Gulf News

Portugal’s Aveiro region stays at the forefront of tech innovation.

Posted: Mon, 10 Apr 2023 08:56:01 GMT [source]

Thus, CCI is an effective way for traders to create a clear pattern of overbought and oversold phases in the market. Trading Fuel is the largest stock market blog, offering free trading ideas and tactics for the Indian stock market. We cover topics related to intraday trading, strategic trading, and financial planning. From the below example, we can see that the buy entry is triggered when the price line crosses the moving average and the CCI comes out from the oversold area.

As a co-incident indicator, if CCI is more than 100, then it reflects strong price action which indicates start of an uptrend. Similarly, if CCI is below -100, then it reflects week price action which indicates start of a downtrend. The Momentum Reversals will trigger with the trend or the grey CCI bar equivalent in the e-signal template. For example MR Sell with trend will trigger until there are 6 or more CCI bars above the zero line which establishes a bullish CCI trend.

Which indicator works best with CCI?

It is extremely important, as with many trading tools, to use the CCI with other indicators. Pivot points work well with the CCI because both methods attempt to find turning points. Some traders also add moving averages into the mix.

Basically, the CCI value is the difference between the current price and the historic average price. Use indicators after downloading one of the trading platforms, offered by IFC Markets. The Relative Strength Index and Commodity Channel Index are both popular technical indicators. The following daily chart of Sun Pharma shows many such short trades with only one of them failing during the time frame under consideration. In the following daily chart of ICICI bank, we see many such examples where this strategy could generate a substantial profit.

What does CCI indicator tell you?

The Commodity Channel Index (CCI) measures the current price level relative to an average price level over a given period of time. CCI is relatively high when prices are far above their average.

Sebi wants to set up a separate legal entity because it would not be possible to offer high salaries to professionals if they are administratively a part of Sebi. The interaction of comorbidity and malignant disease and the validation of the Charlson Index in oncology are discussed. BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following.

Another example of such a situation arising could be high and rising inflation. The CCI indicator shows when the current price level is far above/below the moving average. Few traders use CCI to get an idea about the dominant trend on a longer-term chart; on the other hand, few traders use CCI on a shorter-term chart to generate trade signals in some risky situations. In this strategy, you need to add a simple moving average with the 100-period setting – with the CCI indicator, which improves the quality of the signal and to get trading efficiency.

Though the Commodity Channel Index was initially developed for commodities, it is also used for trading stock index futures and options. Step-MA Filtered CCI is a CCI indicator that is filtered using a stepping moving average function. The Commodity Channel Index measures the current price level relative to an average price level over a given period of time.

When selecting trading indicators, also consider different types of charting tools, such as volume, momentum, volatility and trend indicators. Stepped Moving Average of CCI is a CCI that applies a stepping algorithm to smooth CCI. This allows for noice reduction and better identification of breakouts/breakdowns/reversals.

Is CCI a leading indicator?

The Commodity Channel Index (CCI) can be used as either a coincident or leading indicator. As a coincident indicator, surges above +100 reflect strong price action that can signal the start of an uptrend. Plunges below -100 reflect weak price action that can signal the start of a downtrend.