Contents:

This means standing today and looking into the future; Britannia industries could generate a totally free cash flow of Rs.58917 Crs. A company is expected to be a ‘going concern’ which continues to exist forever. This implies that as long as the company exists, some amount of free cash is generated.

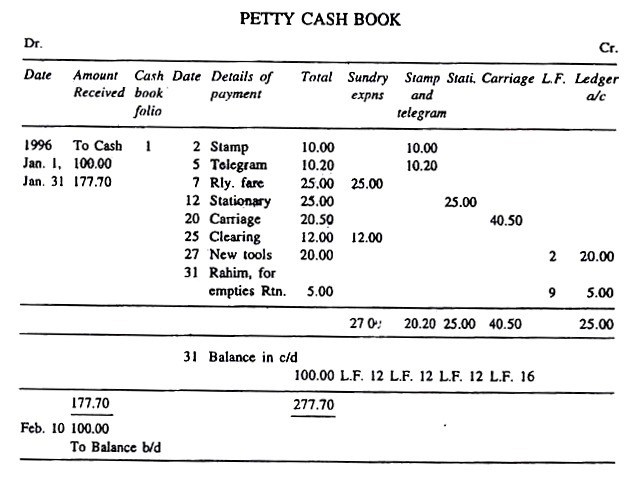

The income statement tells us what a company has earned and spent during a year. Owing to the practice of accrual accounting, not all of these incomes and expenses are cash-based. Investors value information about cash-based inflows and outflows because these have already taken place.

The company must have delayed the payment of its account payables. Let us understand the significance behind changing values of free cash flow. For a better understanding, let us analyse free cash flow with the help of an example.

Free Cash Flow to Equity

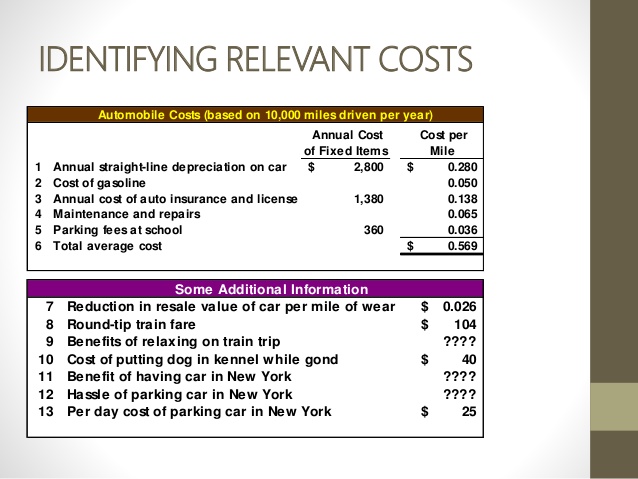

Depreciation comes after EBITDA so we do not need to add depreciation back to EBITDA . However, since depreciation is tax-deductible , we must add the depreciation tax shield, Dep, to EBITDA in order to calculate FCFF. FCF primarily indicates the amount of cash generated by a company each year that is free from all internal or external obligations. Essentially, it reflects the cash which can be safely invested or distribute to shareholders. However, in some cases, it is included in the cost of goods sold.

This fcff and fcfe formula is not as well known or used as typically as its counterpart—earnings earlier than interest, taxes, depreciation, and amortization . If you pay less than the DCF value, your rate of return will be higher than the discount rate. The DCF formula takes into account how much return you expect to earn, and the resulting value is how much you would be willing to pay for something to receive exactly that rate of return.

The value of equity can be determined using the Free cash flow valuation model formula approach by discounting FCFE at the required rate of return on equity. In case financing cash flows are positive and operating cash flows are negative, it may again mean that the company doesn’t have sound operations and therefore has to raise fresh capital to finance them. Shareholders are very sensitive about negative operating cash flows. In case operating cash flows are negative and investing cash flows are positive, it means the company has sold its assets to raise money for its ailing operations. As seen in the illustration, cash flows are divided into three categories—operating, investing and financing. The only difference between the formats is the way of presenting operating cash flows.

What is FCFE?

Please read all scheme related documents carefully before investing. Free Cash Flow to Firm also called Unlevered Free cash flow available to the company, this is a hypothetical figure, say its an estimate what it would be if the firm has no debt. Generally, Investment appraisal is to assess the viability of a project, program or any portfolio decisions and the value they generate for the organization. To evaluate such viability or profitability we use different techniques such as NPV , IRR , discounted payback period, ARR . A very high free cash flow may indicate that a company is not investing enough in its business venture.

- All the above-mentioned techniques use Discounted cash flow in some or other way as the nature of cash flow used.

- Given that we have a variety of ways in which to derive free cash flow on a historical basis, it should come as no surprise that there are several methods of forecasting free cash flow.

- Such a value indicates that the company is not investing money in its business venture, which can be detrimental to its business expansion objectives.

- Accrued liabilities are also accounted for during calculation of WC.

When studying a company’s financial health, the net income is calculated as the revenue less the expenses. The accrual accounting method of calculating the net income ignores the timing of each inflow and outflow. It calculates the simple difference between incoming and outgoing cash for a given period. However, free cash flow excludes many of these revenue and expense accounts.

Our services range from Finance Management to People Management and Strategic Consulting. To understand this calculation better, it is crucial to analyse each component utilised in the formula. Please note that by submitting the above mentioned details, you are authorizing us to Call/SMS you even though you may be registered under DND. We collect, retain, and use your contact information for legitimate business purposes only, to contact you and to provide you information & latest updates regarding our products & services.

What is the importance of free cash flow in accounting?

They factor in a company’s free cash flow standing to gauge the viability and growth prospect of a business venture. Please note that this is same as cash flow from operations on accrual basis we discussed while modeling cash flow. In order to convert accrual into realization we have to adjust changes in working capital. Further the resulting cash flow will be used to repay debts or lead to fresh issue of debt in case of shortfall. Besides, company’s growth plans need funding so capital expenditure has to be sponsored from this cash flow.

To understand what is free cash flow, we look at the actual flow of cash without considering profit. FCF does not consider non-cash expenses that are otherwise featured on financial reports. FCF tells you how much cash the company has left over after making all payments. An extension of the concept of cash flows is the concept of free cash flows. We just discussed how a company should ideally use its operating cash flows to finance investments in new opportunities (i.e. fixed assets).

Alternatively, firms can use the money for stock buybacks once all expenses and debts are paid and reinvestments are factored in. EBITDA, however, could be deceptive because it strips out the cost of capital investments like property, plant, and tools. Free money circulate to the firm represents the money flows from operations out there for distribution after depreciation expenses, taxes, working capital, and investments are accounted for. Free cash flow represents the money, which the company has created for all the financial stakeholders of the company.

Most people invest in the stock market to ensure that they can earn a stable source of income through dividends. Companies that provide dividends to their shareholders are usually profitable. You can determine whether or not a company is profitable through its financial statements and by checking its free cash flow. Free cash flow is the surplus cash that a company generates after fulfilling all the necessary operations expenses. But there is another technical aspect of investments that is just as crucial – free cash flow to equity. FCFF is the cash flow from operations minus capital expenditures.

However, analysts may argue that taking on debt to pay for share repurchases, primarily when shares are being traded at discounted rates; could prove to be a good investment. But you should consider this only if the share prices of the company increase in future. The cash flows available to the company after all its investing needs are met are free to be used for the third avenue of outflows – financing outflows. The financing for running the company is provided by two categories of investors – creditors and equity shareholders.

How to calculate free cash flow from a company’s balance sheet?

FCF, in simple terms, is the money left over after paying for items like payroll and taxes, which a firm can utilise anyway it sees fit. Free cash flow is a measure of how much money a company has available to invest or give to shareholders and debtors without affecting operating cash flow. Poor cash flow does not always indicate that a company is not financially stable. During the times of economic stress, the cash flow statement can give you a better idea of how the company is performing in comparison with the income statement.

How to Evaluate Firms Using Present Value of Free Cash Flows – Investopedia

How to Evaluate Firms Using Present Value of Free Cash Flows.

Posted: Sat, 25 Mar 2017 17:33:35 GMT [source]

The excess pension fund assets should be added to the value of the firm’s operating assets. Likewise, an underfunded pension plan should result in an appropriate subtraction from the value of operating assets. We need to subtract the interest expense now because FCFE is all the cash available to stock holders.

Free Cash Flow Yield: The Best Fundamental Indicator – Investopedia

Free Cash Flow Yield: The Best Fundamental Indicator.

Posted: Sat, 02 Jul 2022 07:00:00 GMT [source]

As with the https://1investing.in/ statement, investors like companies that raise cash predominantly from operating sources. Companies can choose one of the two formats to present the cash flow statement—direct and indirect. The direct method begins with cash sales, i.e. the proportion of sales revenue that was received in cash. It then adds to it all the cash inflows that occurred on account of operating, investing and financing inflows and subtracts from it all the corresponding outflows. This is because the current year’s cash balance is the sum of cash balance at the end of the previous year and the net cash inflows this year.

They record non-cash incomes and expenses on the income statement but are not always sure whether the cash exchange will ever happen. Such transactions result in no immediate change in their cash position. They are recorded as receivables or payables on the balance sheet. People use NOPAT when calculating financial worth added, which is the financial return your small business earns over minimal required return.